About

Partnerships and Potential

The Chimney

Rock Foundation

Rock Foundation

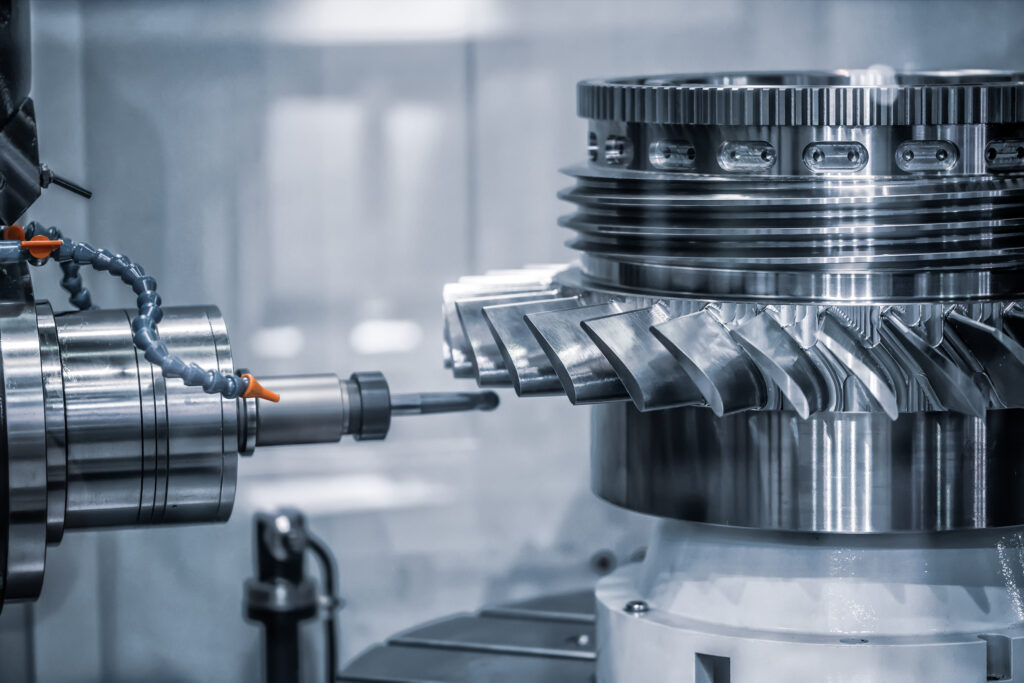

The industrials sector is our sole investing focus. We continuously research and build a network and knowledge base that enables us to make connections, source investments, and seek to create lasting value for the businesses we partner with.

“I was excited to partner with Chimney Rock given its experience in the industrial MRO sector and our shared vision for K&R’s organic and M&A growth strategy.”

Travis Urbanovsky, CEO of K&R²

We’re humble, approachable, and grounded.

Relationships are the foundation in our approach to both business and people.

¹ There can be no assurance that Chimney Rock will be able to adequately implement its ESG initiatives, that any investment will have or create a positive ESG impact or that any ESG considerations will ultimately align with the goals of Chimney Rock, a fund, any individual investors or the market. Given the wide range of ESG investing practices deployed by other asset managers, there is no assurance that Chimney Rock's ESG policy requires Chimney Rock to engage in any particular practice that other entities may require.

² K&R is a portfolio company of a private investment fund managed by Chimney Rock. Neither K&R nor Mr. Urbanovsky is (1) an advisory client of Chimney Rock or an investor in any Chimney Rock fund or (2) earns compensation directly from Chimney Rock or any Chimney Rock fund. However, K&R personnel, including Mr. Urbanovsky, are paid customary compensation by K&R including an annual salary, potential bonus renumeration, and in certain cases, equity ownership in K&R. Accordingly, an investment in K&R by a Chimney Rock fund has the potential to increase the value of K&R and consequently, K&R and Mr. Urbanovsky have an incentive to endorse Chimney Rock.