Strategy

Investment Focus and Criteria

From macro to micro, from big picture to granular details, we seek to partner with management teams to achieve favorable results and returns¹.

Consistent Focus

Chimney Rock is focused on the industrials sector – with an emphasis on Aerospace & Defense, Industrial Products & Services, and Niche Products & Services. Our targeted current and future investments hone in on several key characteristics²:

- Low disruption risk

- Large, growing, and aging installed base

- Consumable components

- High long-term visibility

- Diversified customer base

- Barriers to entry

Our target platform investments typically exhibit the following characteristics²:

- Headquartered in North America

- Platform investments with $5 – $20 million EBITDA

- Transaction values up to $250 million

- Control transactions

- Conservative capital structures

We will consider portfolio company add-on acquisitions of any size.

Focus Areas²

-

Aerospace & Defense

- Commercial and Defense Electronics

- Parts Distribution

- General and Specialty MRO Services

- Systems and Subcomponents

- Consumables

- Satellites and Communications

- Manufacturing

- Business Aviation

- Engineering Services

- Assembly and Kitting

- Composites

- Industrial Products & Services

- Niche Products & Services

The Chimney Rock

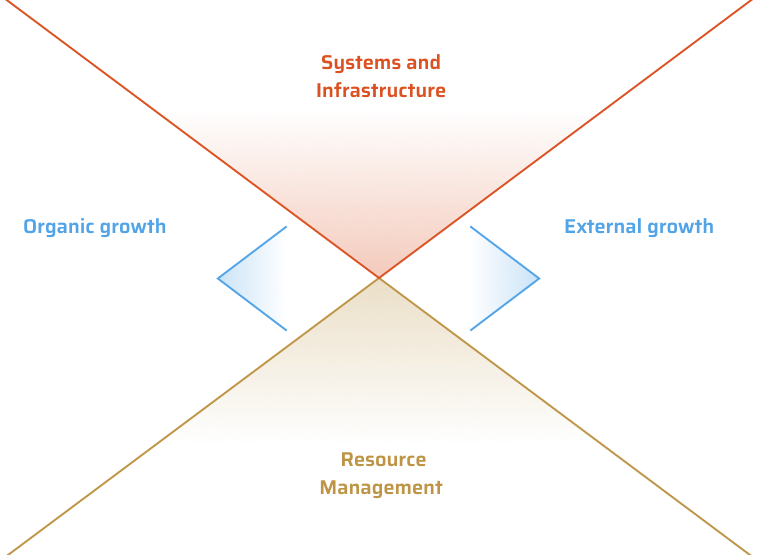

Game Plan³

Executing our value creation strategy requires a balance of careful planning and ongoing evolution. We look for opportunities where we see similar Game Plan elements to prior successes and target situations where we believe we can meaningfully impact growth.